Türkiye's semis imports fall, finished steel trade remains strong

6 November 2025: Rising prices in China since the end of June and higher demand for Turkish finished steel products encouraged producers to increase scrap imports in September by 17.7% year-on-year, to 1.7 Mt, while semi-finished deliveries fell for the first time in the past year.

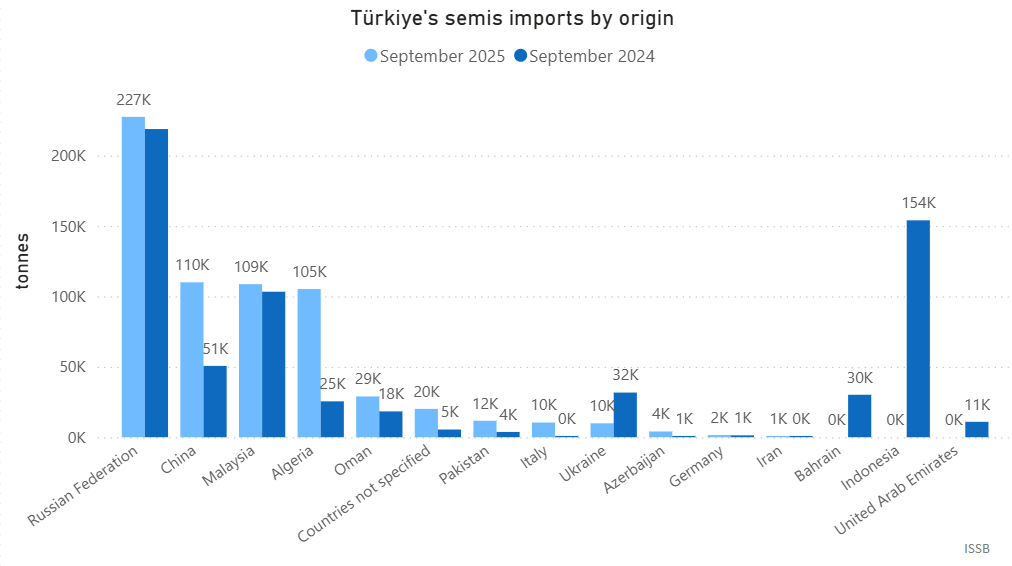

Turkish mills imported 640 kt of semis in September, down by 2.37% from the year before. Deliveries of Chinese material fell from 110 kt to 51 kt over this period, while Indonesian deliveries weren’t recorded in September, following a shipment of 154 kt during the same month in 2024. In the meantime, Algeria's billet prices were competitive, and its exports to Türkiye totalled 105 kt, up from 25 kt a year ago, with January-September figures reaching 550 kt. As reported earlier, China’s semis shipments to Turkish customers fell to 29 kt in September 2025 compared to 202 kt the same month last year.In the meantime, crude steel output in Türkiye rose by 3.27%, to 3.2 Mt over the period.

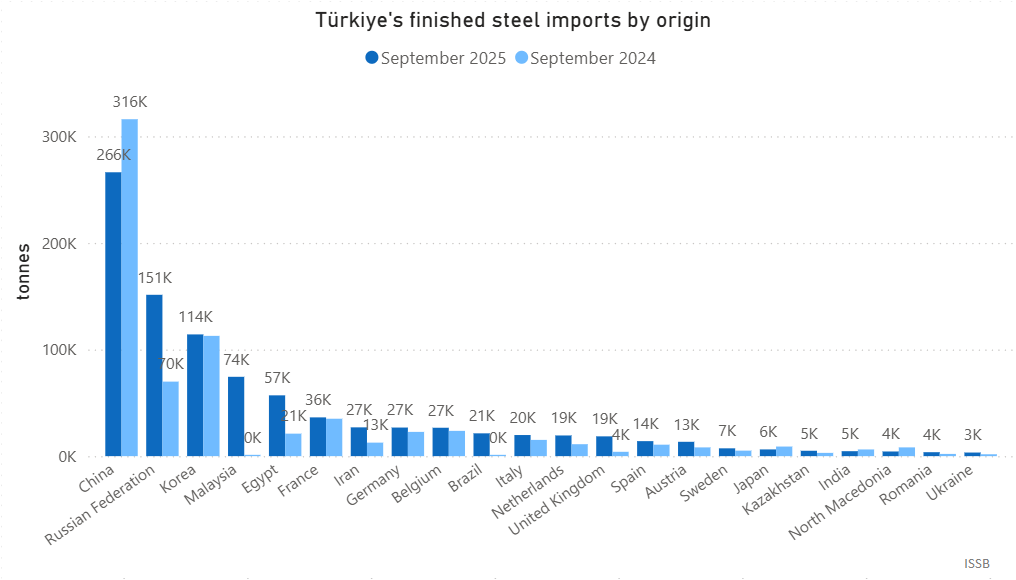

Imports to this market surged by 27.61% compared to September 2024, to 945 kt, mainly of hot-rolled coils from Russia and Malaysia.

But notably, along with strong demand from Europe, where buyers were trying to avoid paying Carbon Border Adjustment Mechanism (CBAM) charges from 2026 and expecting higher local prices, demand increased in the United States. As a result, Turkish finished steel exports in September jumped by 9.92%, to 1.6 Mt, with 59 kt sold to the USA against 9 kt shipped the same month last year and 10 kt in August this year. Rebar accounted for 49 kt of total finished steel shipments from Türkiye to the United States.